Dusk Network’s recent price increase and potential for further growth are driven by retail and medium-sized investors, but concerns remain about the lack of transparency and fundamental adoption metrics, hindering the blockchain’s future.

The token on the dust network is on a massive run. It’s up more than 40% this week alone. Now the question is: what’s behind? This rally is something sustainable because if the price is going up, there’s obviously buyers who are buying here. Now here’s the rally I’m referring to: we are currently at 26 cents roughly, and that has been somewhat of a roller coaster ride. The price tends to pump and then subsequently dump, and we are just starting a recent pump again. Dusk has a very ambitious plan; on the one hand, it wants to be decentralized. It also wants to be regulated but still be 100% privacy-driven, so there’s a lot of big names on the website, and Dusk has tokenizing assets at the core of their unique selling point.

Now. I’m not going to bore you too much with the content on the website because we want to get an edge over the market. We want to get the information that most people do not have or do not look at, and one of those pieces of information is always program activity. So this is the GitHub repository, and here we can have a look at how much activity there is. There are currently programmers actively working on the project, and the answer is yes, somewhat. There was an update two days ago. Also a few updates on the hash algorithm on the Schnor signature scheme for the jup jup elective curve group.

I’m not pretending to understand what this means; this sounds pretty much like technical mumbo. Jumbo and I actually do have a tech background, but let’s have a look to see if we can trust the team, because that’s a nice thing about dusk. They are 100% transparent about who’s working on this. This is not just a project run by people who are anonymous, so we’ve got the founder here. Who’s also given some interviews on YouTube. He’s been working on dusk for six years. Now. Then we’ve got the CMO, who’s interestingly enough not mentioning his CMO title in LinkedIn. It’s only written on the website. Then we’ve got another founder, also from the Netherlands, just as the CEO, and here we’ve got the head of technology, or CTO. He’s been with Dusk for 5 years, so they’re a pretty stable team. No real red flags here. The question, though, is how much has been delivered so far in those 5 to 6 years, and for that, we can have a look at the Explorer. So dusk does not just have a token on Ethereum and on the Binance smart chain. It also has its own blockchain; that’s the whole unique selling point, but look at this.

There are a ton of blocks being mined, but all of them have zero transactions when we look at the recent transactions. There are some transfers, but they’re not massive. Unfortunately. The charts and statistics on the Explorer are also pretty useless. You can’t really see how the number of transactions is developing. Over time. We only have a little world map here, maybe with the miners. We’ve got some price data and some market cap data, but that’s about it when I see an independent blockchain that has been worked on for more than 5 years. I want to see the number of wallets, the number of transactions, and all of that fundamental adoption. Metrics. Not having this transparently on the website or in Explorer is obviously not a good sign.

Now here’s a quick glance at the white paper. It’s very technical. It also sells a lot of technical mumbo-jumbo; who knows how much is really behind this? This is a technology that’s still searching for its problem, but here’s the big question: why can the price suddenly pump like this? Who’s buying here? Because obviously if the price goes up, there needs to be demand. Is this small retail, or are these the big whales, or are these the centralized exchanges? Let’s have a look at the chain. I built a tool that I made available to the premium members that looked at retail versus Wales and dusk. We’ve got two different kinds of tokens. We’ve got one on the Ethereum blockchain and one on the Binance smart chain, both on the left side. We see the number of wallets that hold at least 1,000 dusk tokens at the current price. That’s $266. That’s retail, which has some play money in it. This is a very long-term chart starting in 2019. In the middle. We’ve got the medium-sized holders, so that’s now 10,000 tokens, or $2,600 worth of tokens.

On the right,. We’ve got Wales here. We’re looking at $26,000 worth of the token. Now those are very iric movements. Some might be related to centralized exchange listings or to staking programs. Etc. Let’s just look at the last 30 days, and here we do see quite a bit of growth—a bit under 10% for small retail, around 5% for medium-sized retail, and also around 5% for Wales. Now that this is the Ethereum-based token, let’s have a look at Binance. Smart chain base token, and let’s again look at the last 30 days. Here the accumulation is not as clear, but in general, the numbers are way smaller on ethereum. We’ve got more than a thousand holders with 10,000 tokens on the Binance smart chain; that’s only a bit over 100. So it appears that the price appreciation in the last month was really driven by people that accumulate, and that’s both retail as well as Wales.

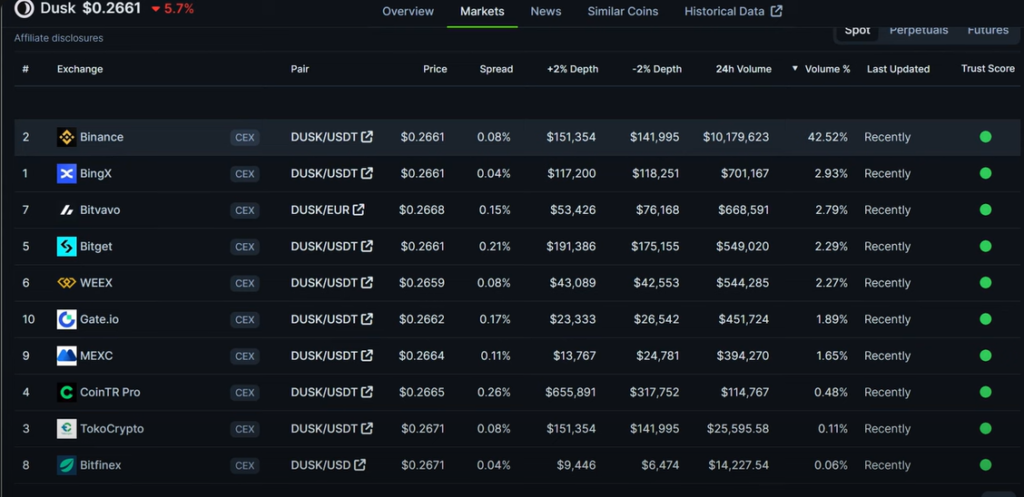

One reason for those massive ups and downs could be that the circulating supply of the Dust Token has increased quite a bit from what was once 34 million, more than 10x, to now 450 million, but it appears that the growth isn’t that massive anymore. In the last year,. The circulating supply increased by 99.1%, so yes. The price did pump and dump quite a bit in the past, but maybe the dump won’t be that hard given that token. Inflation isn’t that high anymore, and now there is quite some involvement by the centralized exchanges. The 24-hour trading volume on Binance alone was $10 million for the perpetual futures. It was 64 million worth of the token, but still, relative to the market cap, that’s not massive. With the market cap at 123 million, so could the price. On the other hand, I do think there is accumulation on all fronts.

Unfortunately, there isn’t much fundamentally going on here. It seems like the blockchain isn’t used that much for a project that’s been running for more than 5 years. I want to see more on-chain metrics, such as how many people are actually using the Dark Network and, of course, how many real-world assets have already been tokenized and who’s trading those I want to know all of this, but I couldn’t find that data. If it’s your first time here for Fe to subscribe, I will publish you. This regular like would be very much appreciated as well. It helps the channel grow. There’s also a free telegram link down below.

- The Dusk Network token is up 40% this week, with a plan to be decentralized, regulated, and privacy-driven.

- Dusk Network’s GitHub repository shows some recent programmer activity, including updates on the hash algorithm and SCHNOR signature scheme.

- The Dusk Network team is transparent and stable, but the question remains about how much has been delivered in the past 5–6 years.

- Dusk Network lacks transparency and fundamental adoption metrics, making it a concerning sign for the blockchain’s future.

- Dusk Network’s price pump is driven by retail investors and medium-sized holders, with potential influence from centralized exchanges.

- The Dusk Network token has seen growth in the last 30 days, driven by accumulation from both retail and large investors.

- Dusk Network’s circulating supply has increased, leading to price fluctuations, but with decreased inflation and involvement from centralized exchanges, the price could potentially rise further.